Luceiro Capital Value Fund FI

Value Investing in the Real Economy

Luceiro Capital Value Fund Fl, (ISIN: ESO158707002, Bloomberg: LUCCPVE) is a global equity investment fund with a Value approach. The fund invests at least 75% of its total exposure in equities, and up to 25% of its exposure in fixed-income assets; taking as a reference the MSCI World Net Total Return EUR Index. The fund is regulated by the CNMV under UCITS regulations.

The investment philosophy of Luceiro Capital Value Fund Fl is focused on value investing, acting as a long-term investor and with a vocation to facilitate its participants to invest in the real economy with the perspective of an entrepreneur who focuses on identifying quality companies with proven business models and sustainable competitive advantages in industries with favorable dynamics, led by a good management team and whose intrinsic value is not reflected in their share price.. The fund invests in company shares, with an ideally permanent time horizon, and seeks Returns on Invested Capital (ROIC) that, in addition to their solidity, generate a sustained satisfactory profitability. In the selection of assets, fundamental analysis techniques of all the companies in the portfolio are followed, as well as extensive field work visiting companies and industries.

Luceiro Capital Value Fund, Fl was created through an investment advisory agreement between Luceiro Capital and Renta 4. Luceiro Capital acts as investment adviser to the fund, which is managed by RENTA 4 GESTORA, SGIIC, SA and is the custodian of RENTA 4 BANCO, SA.

Philosophy

We focus on identifying good companies that are good investments and that we can hold for the long term with an entrepreneur's perspective. Among others, companies with a solid track record of revenue growth; stable and defensible margins in the top quartile of the industry; leaders in their industry; product companies; high ROCE / ROIC; moderate financial leverage; high-level management with equity exposure; industries with numerous opportunities for organic and inorganic growth; attractive valuation with a high margin of safety.

System

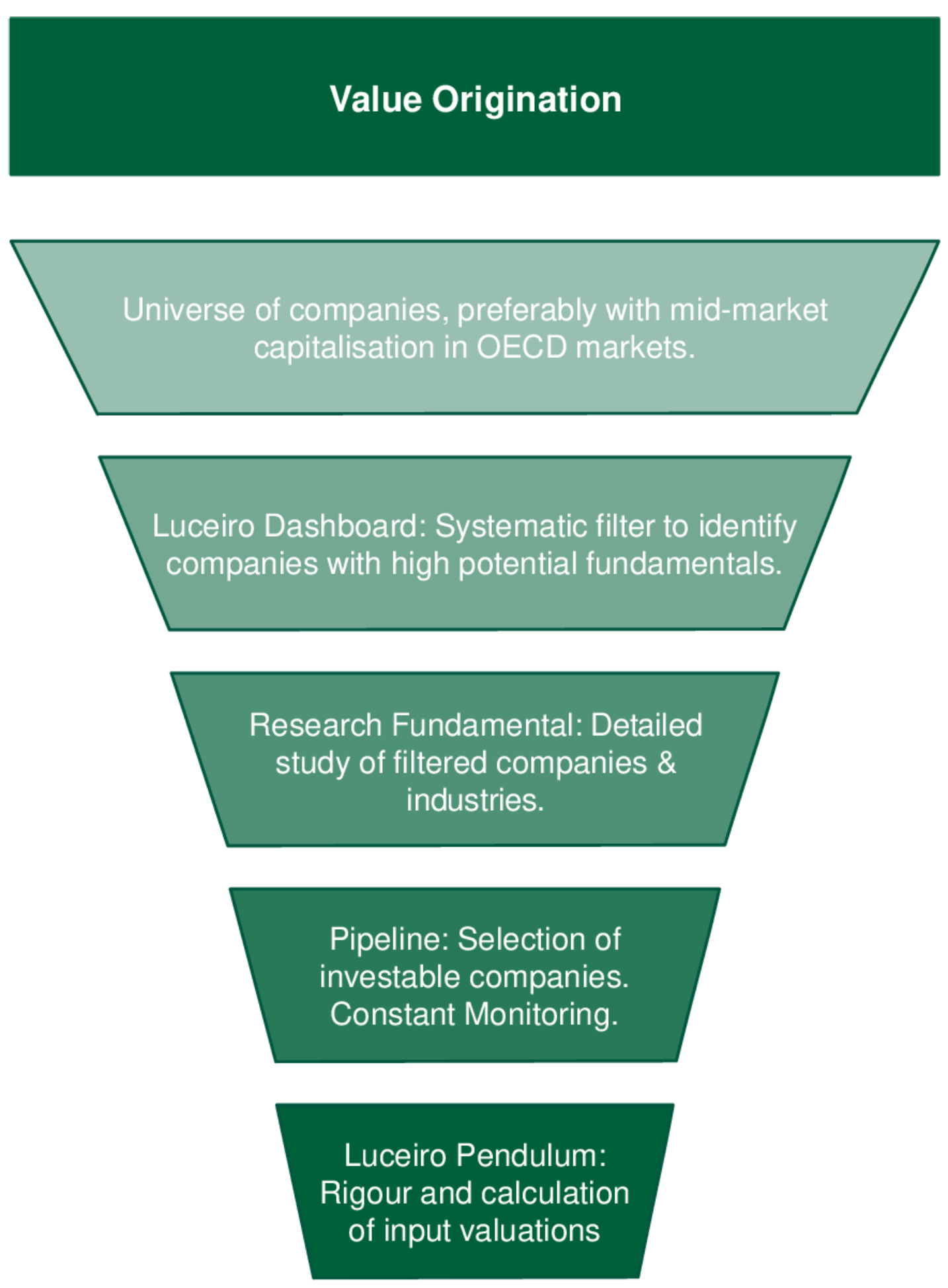

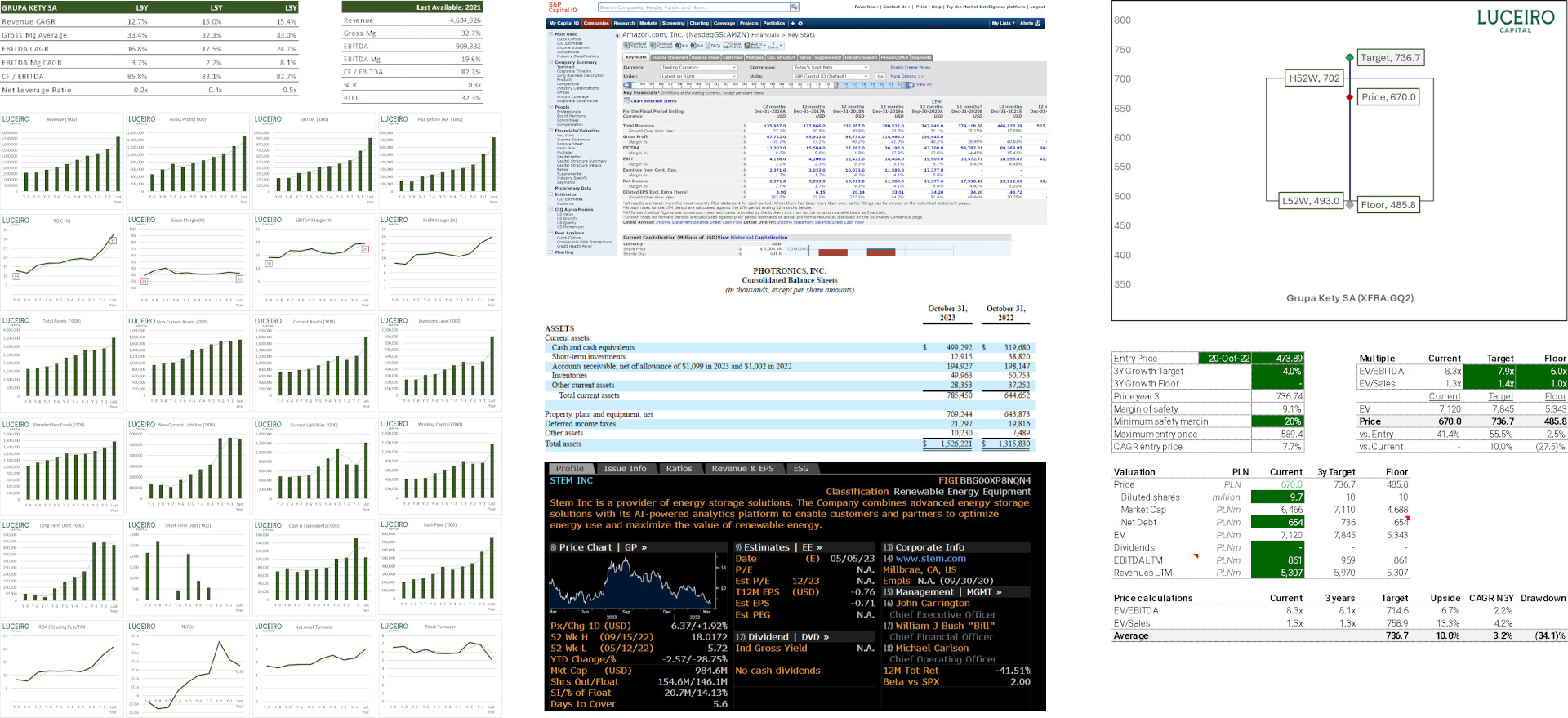

Thanks to our internally developed tools - Luceiro Dashboard (Analysis) and Luceiro Pendulum (Pricing) - as well as access to global databases and company visits, we have developed a search, filtering and fundamental analysis system that helps us to identify in a standardized and aseptic way opportunities that meet our investment criteria.

The dual analysis of both private and listed companies and markets (Luceiro Cross- research) provides a competitive advantage that offers us a differential perspective and understanding.

Portfolio

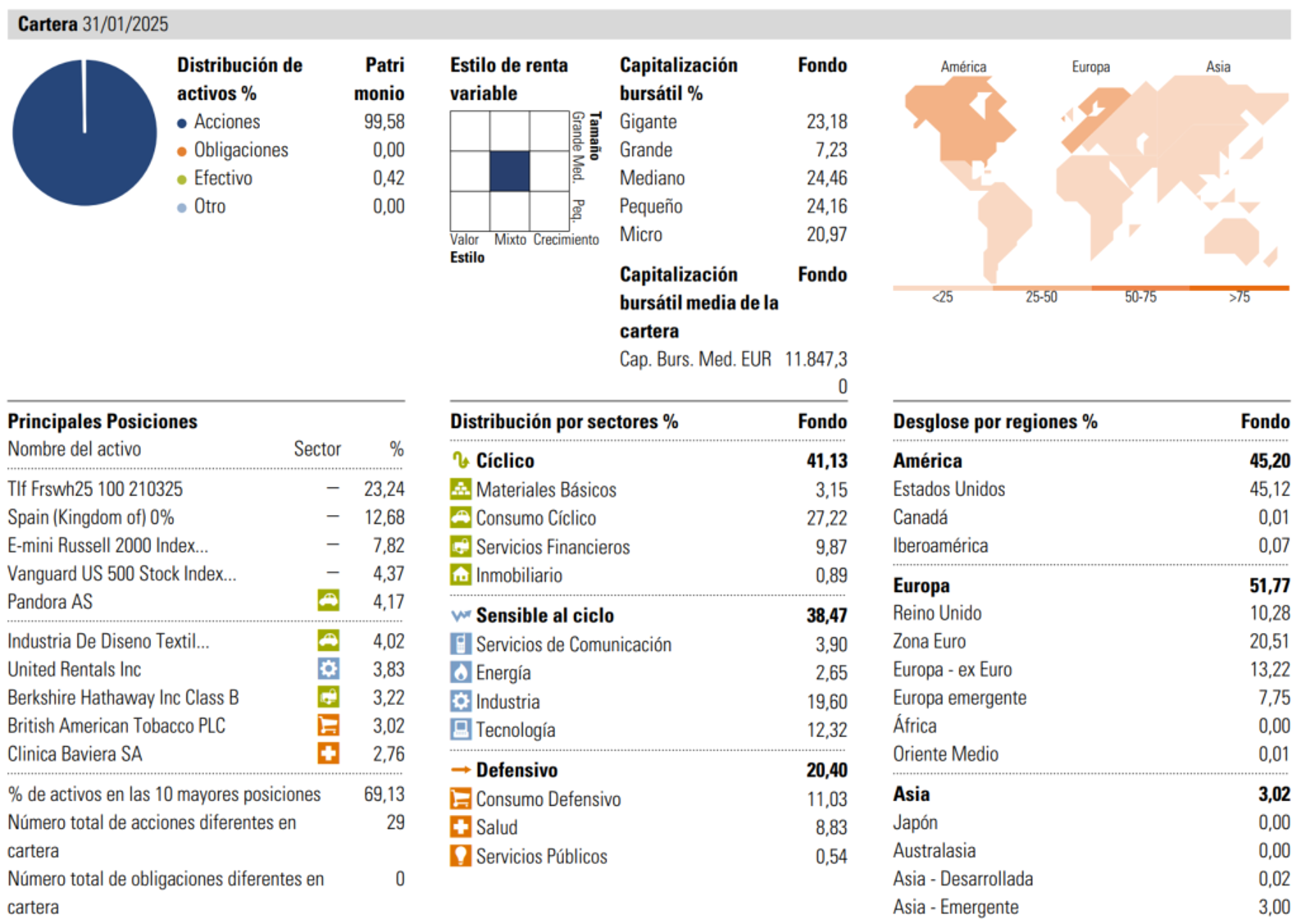

The global nature of the Luceiro Capital Value Fund, Fl portfolio is based on the broader MSCI World Net Total Return EUR Index. However, the fund invests in smaller companies than the index average, and the team studies the Mid-Market in detail at a global level. The base of 80% of the portfolio is governed by our Luceiro Value strategy. This is combined with a Macro strategy (10- 20%) in which it takes exposure to global indices and fixed-income assets based on our macroeconomic vision. Finally, a small part of the portfolio (10-15%) is allocated to tactical positions in companies whose valuation suffers some type of temporary dislocation due to corporate actions.

We provide an investment solution based on the Value Investing philosophy, acquiring stakes in high-quality listed companies with favourable dynamics. We focus on offering a sustainable and long-term return for our investors, thinking like owners & operators of the businesses in which we invest.

Investment Philosophy

Luceiro Capital applies the Value Investing philosophy , with a long-term approach and a global reach, both at the sector and regional level.

Dedication

Our goal is to identify good companies that are good investments: companies with a track record of good management and a well-defined and executable long-term strategy. We prioritize product companies that are leaders in their sectors.

Value creation

The above translates into top-level fundamentals, the ability to grow above the benchmark, and generate added value in the long term: high and/or increasing ROIC; history of sustained revenue growth; stable and defensible margins in the top quartile of the industry; high degree of conversion to cash; moderate financial leverage; etc.

Risk-adjusted returns

All of the above, together with a deep knowledge of the industry and macro variables, based on an assessment in which there is a positive asymmetry between the upside potential and a high safety margin on the downside, we can identify value opportunities that allow us to generate alpha by working to understand and limit risks in the portfolio.

We invest in value, with a permanent time horizon, with a rigorous and proven search process that allows us to objectify our identification and selection os opportunities

Strategy

Value Origination

Portfolio Management

Evergreen Value Management

- Portfolio companies have a long-term investment time horizon. Ideally the portfolio is permanent.

- The ability to increase exposure from the invested companies means that, in the UCITS strategy, the fund can constantly rebalance capital inflows by allocating them to the portfolio.

- The number of positions in the fund is not limited, and the strategy encourages increasing the number over time, benefiting from advantages such as diversification by industry and geographic area.

Risk Management

- Although the philosophy is to maintain positions in the long term, there is active risk control and portfolio review, based on constant monitoring of invested companies. Reasons that justify an underweighting or sale of a position include:

- Overvaluation: expansion of multiples to levels that we consider excessively high, concentration of positions in the maximum quadraent of the pendulum.

- Disruptive element: Change for the worse in the company's strategy, policy or philosophy; regulatory or other change that affects the business thesis: etc.

- Opportunity cost: Existence of options with better potential returns in the pipeline.

- Corporate events: Takeover bid by another company or achievement of the expected event in special situations.

Methodology

- Fase I: Luceiro DashboardIdentifying good companies based on fundamentals.

- Fase II: Luceiro Cross-Research Rigorous due diligence of company operations, industry and macro. Company visits.

- Fase III: Luceiro Pendulum StarIdentifying good investments based on valuation.

We focus on companies with differentiated products and services that have demonstrated over the years their ability to continuously improve and adapt, building competitive advantages and strong management teams to achive consistent returns.

Portfolio: Main positions

Own elaboration. Information as at January 31, 2025.

4.36%

4.20%

4.00%

3.36%

3.16%

2.89%

2.82%

2.71%

2.38%

2.29%

2.24%

2.22%

2.18%

2.18%

2.10%

2.09%

2.06%

1.95%

1.93%

1.88%

Luceiro Capital Value Fund has a global and multi-sector approach. We prioritize developed/OECD regions or countries, with good macro dynamics and legal security and product sectors and/or companies over services.

Source: Morningstar. Information as of January 31, 2025.

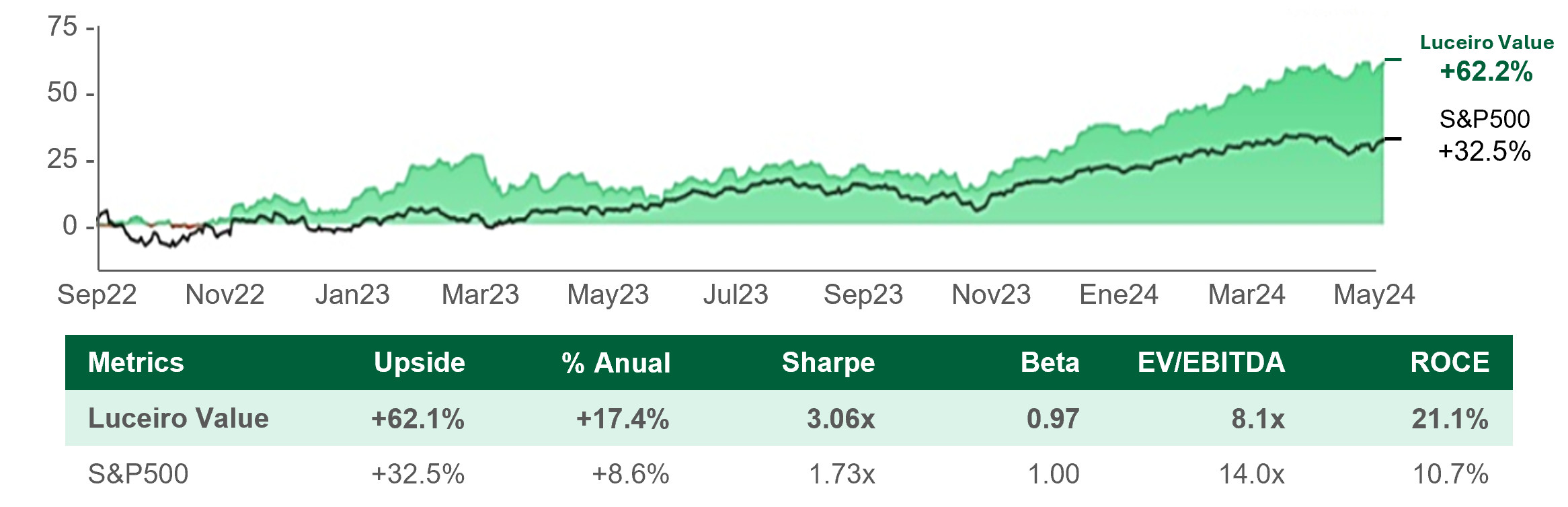

We work to generate sustained value, but not only in absolute returns, but also by rigorously controlling the risk profile of our portfolio.

Performance

Our commitment is to be consistent and systematic in our work. The rigor of our methodology has so far resulted in a portfolio of high-quality companies that have managed to generate returns higher than the benchmark. In the short term, we enjoy the daily work of searching, finding and investing in companies in which we feel part of their business project. In the long term, the market puts a price on companies and on our work.

Own elaboration. Information as of February 28, 2025. Past performance is no guarantee of future performance.

Access the fund's performance and latest statistics through:

Until June 2024, our Value strategy was managed through a closed-ended investment vehicle, moving to a UCITs investment fund, with an approval date of 21 June 2024.

Own elaboration. Data prior to 30 June 2024. Past performance is no guarantee of future performance.

We invest with an ideally permanent time horizon, identifying Value opportunities in industries with favorable dynamics in which we have developed sector knowledge.

Fund Details - Luceiro Capital Value Fund, FI

Key facts

Registration date 21-06-2024

Bloomberg Ticker LUCCPVE:SM

Asset Manager Renta 4 Gestora, SGIIC, S.A.

Address Paseo de la Habana 74, 28036 - Madrid (España)

Depositary Renta 4 Banco, S.A.

ISIN code ES0158707002

Auditor Ernst & Young S. L.

Fund registration number at the CNMV 5877

Fund profile

Currency EUR

Fund type: International equity

Legal form UCITS

Investment style Value

Investment profile

Minimum initial investment €100

Management commission 1.00% (On assets) + 7.50% (On results)

Custodial fee 0,08%

Net Asset Value Daily

Refund fee 1% (For participants less than 90 days) 0% Thereafter

Fund Documentation - Luceiro Capital Value Fund, FI

How to invest in Luceiro Capital Value Fund FI.

With the launch of Luceiro Capital Value Fund Fl together with Renta 4, at Luceiro Capital we want to give investors the opportunity to participate and own companies that create value in the real economy.

The fund's main distributor is Renta 4 Banco, SA Renta 4 began its activity in 1986 and today has the trust of more than 100,000 clients: retailers, high net worth individuals, companies, institutions and financial institutions. It has been listed on the stock exchange since 2007 and currently has assets under administration or management exceeding 30 billion euros. It is the only independent financial institution providing investment services listed on the Spanish stock exchange (Ticker BME: R4). Access more information and analysis of R4 on the website www.r4.com

Private or institutional banking investors can contract the Fund from other entities through AllFunds.

You can invest in the fund from 100 Euros through an account opened at Renta 4 Banco. The account opening process is simple and can be managed online, or in one of its 64 offices spread throughout the national territory with investment specialists. The EFA II accredited Telephone Service Center will answer all your questions from 8:00 a.m. to 8:00 p.m. Monday to Friday at 900 92 44 54.

Once the account is opened, you can invest in the fund in different ways: Contribution from liquidity in the account (both in Renta 4 Banco and in other bank accounts), Transfer from another fund in the entity or Transfer from another fund inanother entity.

For any additional information you can contact the Luceiro Capital team at valuefund@luceirocapital.com or by phone at +34 881 87 44 90

Private and institutional banking investors can request the fund from other banks, asset managers or financial institutions through Allfunds on its intermediation platform. For this service, you must consult with your financial institution to find out the minimun investment required by your entity and the contracting process.

For any additional information, you can contact the Luceiro Capital team at valuefund@luceirocapital.com or by phone at +34 881 87 44 90

Luceiro Capital launches Luceiro Capital Value Fund, FI in partnership with Renta 4, the only independent financial institution specializing in investment products listed on the Spanish stock exchange (BMEX: R4)

FAQs: Frequently Asked Questions

To invest in the fund with the lowest possible fees, the most recommended method is to do so through Renta 4 Banco (www.r4.com).

To invest from other entities, this can be done through platforms such as Allfunds, etc. (subject to a cost applicable by said platforms).

- Contribution from liquidity in the account (both in Renta 4 Banco and in other bank accounts)

- Transfer from other funds in Renta 4 Banco

- Transfer from other UCITS funds in different entities.

Minimum initial investment: €100 (*) and €100,000 (**). Minimum investment to maintain: €100 (*) and €100,000 (**).

(*)During the first 12 months from the registration of the fund or until it reaches a capital of 10 million euros, the minimum investment will be €100 (**). Afterthis period or from the time it reaches the aforementioned capital, the minimum investment will be €100,000€.

Luceiro Capital Value Fund, Fl is subject to a commission of 1% on assets and 7.50% on fund results (establishing a watermark), as well as the custodian commission of 0.08% on assets.

The Management Company will apply a performance-based management fee calculation system that uses reference net asset values. The performance-based management fee may only be paid when a positive return has been accumulated during the performance reference period, which will cover the last 5 years of the fund on a rolling basis.

EXAMPLE OF PERFORMANCE FEE CALCULATION: The Fund uses a performance management fee calculation system based on reference net asset values, with the crystallization date being December 31. Assuming that at the end of the year the result is 100,000 euros*, applying 7.5% to these results, the fee would be 7,500 euros. The following year, if the net asset value of December 31 of the previous year is not reached, no performance management fee will be applied. On the other hand, if this net asset value is exceeded, only the excess will be charged on December 31, with the current net asset value on December 31 being established as the new reference net asset value.

Contact

If you want to know more about Luceiro Capital, please do not hesitate to contact us.